For anyone who is saving for retirement, the best way to assist make sure achievement is by preserving constantly (Fidelity implies saving 15% of your respective money yearly, like any match you can get from a employer) and investing properly on your age.

No income or contribution limitations: Typically, there won't be any income or contribution restrictions to opening an account.

A brokerage account is useful for normal conserving and investing. It can be utilized by anybody for several different plans. As a result, it is a very common account employed for retirement.

Check out all tax preparing and filingTax credits and deductionsTax formsBest tax softwareTax preparation Fundamental principles

Retirement plans evolve with the several years, which means portfolios and estate plans really should be updated as needed.

Today's home finance loan rates30 12 months home finance loan rates5-12 months ARM rates3-calendar year ARM ratesFHA mortgage loan ratesVA mortgage loan ratesBest home finance loan lenders

On the whole, the older you will be, the greater your portfolio needs to be centered on income as well as preservation of capital. This suggests a higher allocation in much less risky securities, including bonds, that gained’t give you the returns of stocks but will probably be fewer risky and provide profits you could use to live on.

A standard rule will be to budget for at least 70% within your pre-retirement profits for the duration of retirement. This assumes several of your expenses will disappear in retirement, and 70% will be sufficient to deal with Necessities.

Figuring out what you desire and picturing your self obtaining your goal may help you see the actions You will need to reach your spot. To start visualizing your best retirement ever, think about these thoughts.

What about conserving for medical costs? These criteria plus more make planning your retirement paycheck tough for Lots of individuals, particularly when they’re decades from retirement.

When funded which has a money-price life coverage plan, death Advantages are offered to offer a continued periodic payment or even more info a lump-sum payment towards the relatives within the event of the executive's death. Depending on the aspects in the policy, these benefits can help a surviving spouse and most likely the executive's dependents.

Several retirement industry experts really encourage people to help keep working until finally age 70, To optimize your savings and your Social Stability Rewards.

Retirement age: Enter the age you plan to retire. Age sixty seven is considered whole retirement age (once you Obtain your complete Social Security Gains) for people born in 1960 or afterwards.

A defined contribution SERP delivers periodic contributions to somebody personnel account. The cash remains invested for the worker right up until retirement, Loss of life, or maybe a incapacity triggers payment. Recreation Plan

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now! Jane Carrey Then & Now!

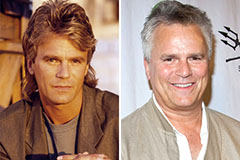

Jane Carrey Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!